What is a Medicare Supplement Plan?

A Medicare Supplement (also referred to as Medigap) helps Medicare eligible individuals with pay for the extra costs that Medicare often does not cover. These medical costs can include copayments, coinsurance, and deductibles.

Supplement plans cover the costs you’re responsible for with Original Medicare which may include:

- Medicare Deductibles

- Medicare Coinsurance

- Hospital Costs for Medicare Un-covered Excess Days

- Skilled Nursing Facility Costs for Medicare Un-covered Excess Days

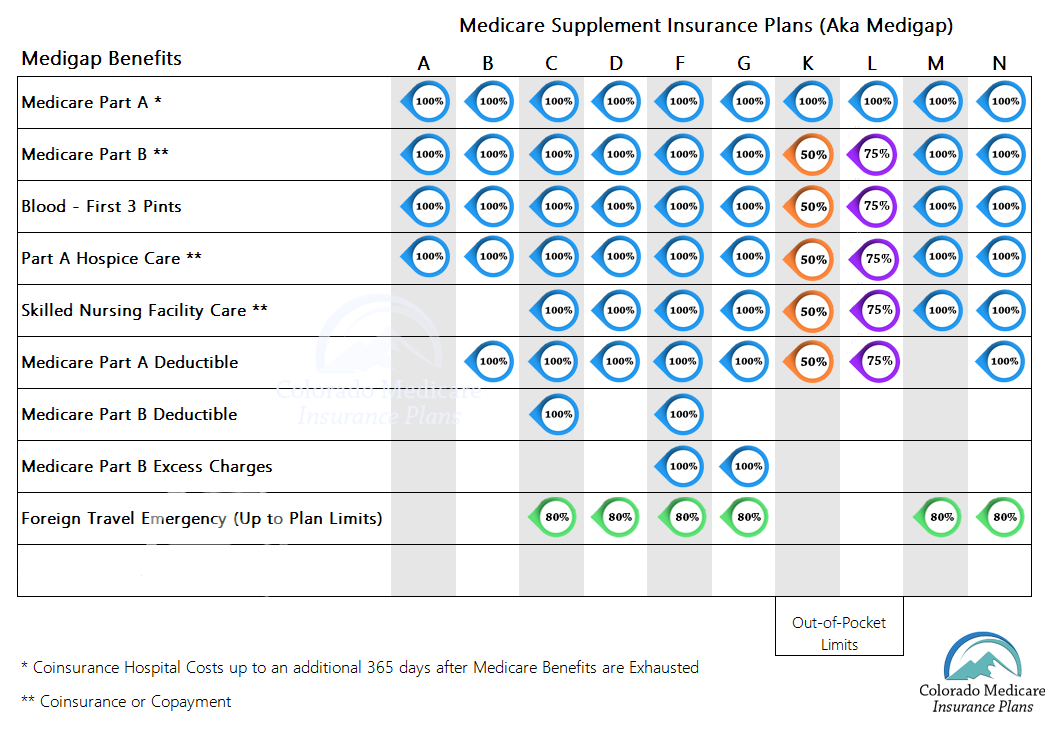

There are numerous Colorado Medicare Supplement plan options available to you and each plan has a different, yet standardized, benefits and coverage for you to consider. Medicare Supplement plans are offered by private insurance companies.

When is the Medicare Supplement Enrollment Period?

- A Medicare Supplement can be obtained during the Medigap six-month open enrollment period. This open enrollment period begins the month you turn 65 and enrolled in Medicare Part B.

- You can apply for a Medicare Supplement before this enrollment period, and your Medicare Supplement coverage will be effective the first day of the enrollment period

- Important! – Enrollment in a Medicare Supplement policy “outside” of the Open Enrollment period will most likely require medical underwriting.

To avoid medical underwriting while enrolling in a Medicare Supplement plan, you must have one of the following situations:

- You are enrolled in a Medigap plan that discontinues coverage by no fault of your own.

- Your employer coverage ends while your enrolled in Original Medicare

- You’re enrolled in a Medicare Advantage plan and you move out of their Service area.

- Your Medigap insurer goes out of business or deceived you.

- During the first year of enrollment in a Medicare Advantage plan at age 65 you change your mind and return to Original Medicare.

- You disenrolled from your Medigap plan to enroll in a Medicare Advantage plan for the first time and then changed your mind again to return to Original Medicare.

- Your enrolled in a Medicare Advantage plan that leaves the Medicare program.

Who is Eligible to Enroll in a Supplement?

- You can buy a Supplement policy only if you already have Medicare Part A and Part B

- A state resident of where the plan is offered

- Age 65 or older

- In some states, under 65 with a disability or end stage renal disease.

What are the Costs Associated with Supplement Plans?

Keep in mind that each insurer prices its Colorado Supplement plans differently.

There are three ways an insurance company prices its Medicare Supplement plans:

- Under a community-rated or no-age-rated plan, all beneficiaries pay the same Supplement costs and premiums, regardless of age

- In an issue-age-rated or entry-age-rated plan, Supplement premiums are based on your age when you first enroll

- Under an attained-age-rated plan, your Supplement premiums are based on your current age in a given year

Do You Need an Licensed Health Agent?

What Must Supplements Offer?

All Colorado Medicare Supplement plans must cover all or a portion of the following basic benefits:

- Medicare Part A coinsurance costs up to an additional 365 days after Medicare benefits are exhausted

- Medicare Part A hospice care coinsurance or copayments

- Medicare Part B coinsurance or copayments

- First three pints of blood used in a medical procedure

What are the Pros and Cons to Supplement Plans?

Pros:

- Plans cover all or part of Original Medicare’s uncovered expenses

- Guaranteed Issue with 6-month enrollment when first eligible

- Plans are Easy to Compare

- Provider Flexibility – No Network Restrictions (Ie.Like HMOs)

- Some Plans offer Coverage for International Travel

Cons:

- Your monthly premiums can be relatively high compared to other Medicare Insurance Plans

- You may not be able to enroll after the initial enrollment period

- You maybe subject to medical underwriting after the initial enrollment period

- Plans are difficult to switch once enrolled

- Supplement plans don’t include Part D prescription drug coverage