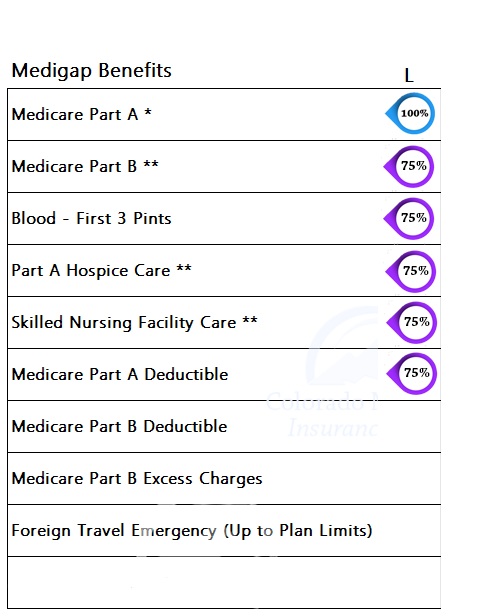

Medicare Supplement Plan L, like Supplement Plan K, requires you to pay a portion of select costs including co-payments, coinsurance, and deductibles. Colorado Supplement Plan L is a good option if you have low medical expenses, prefer a lower monthly premium, and are ok assuming some medical costs.

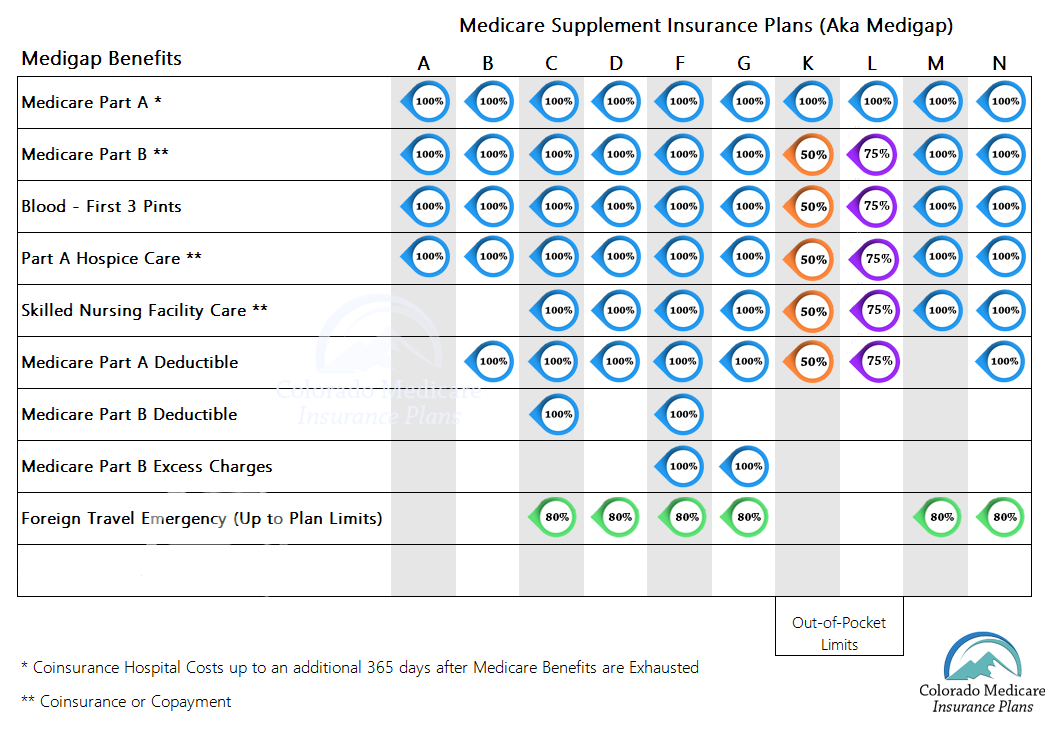

The primary difference between Supplement Plan L and Supplement Plan K is that Supplement Plan L offers 75% of cost coverage compared to Plan K’s 50% cost coverage.

coverage compared to Plan K’s 50% cost coverage.

Medicare Supplement Plan L includes the following benefits:

- 75% of Medicare Part A coinsurance for hospitalization in addition to coverage for one additional year after Medicare benefits end

- 75% of Medicare Part B coinsurance for medical expenses — usually 20% of Medicare-approved expenses — or co-payments for outpatient services

- 75% after the first three pints of blood you receive as a hospital inpatient or outpatient (whereas original Medicare typically covers any pints of blood you receive after the first three)

Medigap Plans...

Do You Need a Licensed Health Agent?

- 75% of Medicare Part A coinsurance for hospice care

- 75% of Medicare Part B preventive care coinsurance

- 75% of Medicare Part A deductible

- 75% of Skilled nursing facility care coinsurance

Medicare Supplement Plan L does not cover:

- Medicare Part B deductible

- Medicare Part B excess charges

- Foreign travel emergency coverage