What is Medicare Part D?

Medicare Part D is an optional form of coverage with Medicare that’s largely designed to cover the costs associated with any drugs or medications that you require. While everyone is automatically enrolled into Medicare Part A and Part B upon reaching the age of 65, you need to enroll in Part D yourself.

Part A and Part B Medicare only cover a small portion of medications, primarily medications that you receive as a hospital inpatient or ones that you’re provided with at a doctor’s office in an outpatient setting.

There are two different types of Medicare Part D prescription drug coverage that you should be aware of, which all depends on whether you’re enrolled in standard Medicare or what is known as Medicare Advantage, commonly referred to as Medicare Part C.

The standard Medicare Part D prescription drug plan is available as a benefit to your Medicare Part A and Part B plan. The other type of Medicare Part D coverage is available by selecting a Medicare Advantage plan that includes coverage for your prescription drugs.

Medicare Part D Eligibility

For standard prescription drug coverage, you’ll need to have at least Medicare Part A or Medicare Part B, though you’ll also be eligible for the plan if you’re enrolled in both Medicare Part A and Part B. It’s also important that you live in a service area that offers one of these prescription drug plans.

If you’re considering applying for a Medicare Advantage plan, there are a few additional eligibility requirements that you should keep in mind. For instance, you need to be enrolled in both Medicare Part A and Part B and will also need to live in a service area that include Medicare Advantage plans. In the vast majority of cases, it’s also a requirement that you can’t have end-stage renal disease.

For either of these plans, you’ll typically need to be at least 65 years old to be eligible for enrollment. However, it is possible for you to qualify for Medicare Part D coverage if you’re under 65 years old and have been receiving social security disability insurance. To qualify, you will need to have been receiving these checks for two years before enrolling.

Medicare Part D Coverage

The type of coverage provided by a Colorado prescription drug plan varies from plan to plan. Each of these plans has its own unique list of prescription drugs that it covers, which is referred to as a formulary. Within the formulary, these drugs will often be divided into several different tiers, typically to indicate cost differences.

Drugs within a lower tier will cost less to purchase. In the event that a prescription drug you need is in a higher tier, it’s possible that the doctor prescribing the medication can ask for an exception so that you can pay a lower co-payment. While enrolled in one of these plans, it’s possible for the formulary to change. If so, you will need to receive a written notice of the change within 60 days of it taking affect.

Medicare Part D Enrollment Periods

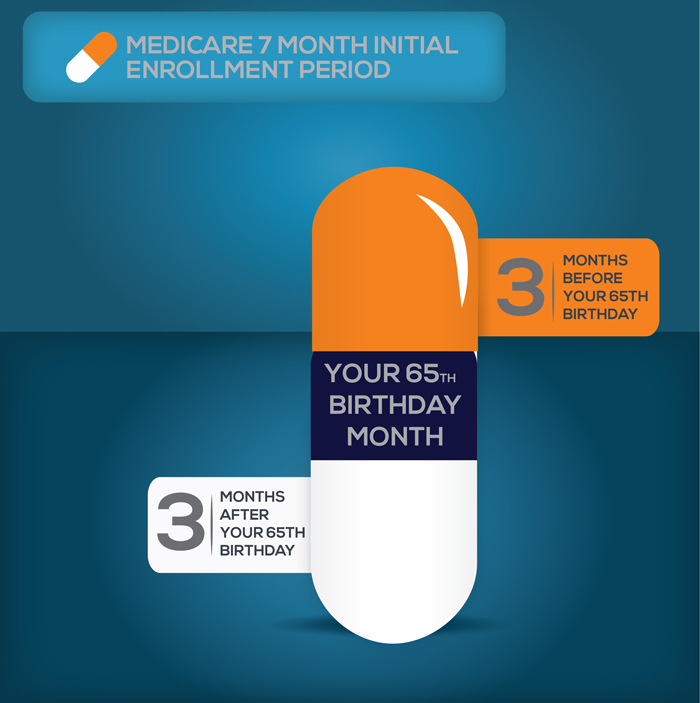

There are two separate enrollment periods for Medicare Part D, commonly known as the initial enrollment period and the annual enrollment period. The IEP for Colorado prescription drug plans are the same as that of the Part B plan, which is basically a seven-month period that begins for the three months before becoming eligible for Medicare and extends three months past the month you became eligible for Medicare, which is usually your 65th birthday.

If you’ve been a part of a Medicare program before 65 because you are disabled, a new enrollment period for Part D will start once you turn 65 and will extend for the same seven months mentioned previously. If you don’t join in this initial period, you’ll have to do so during an annual enrollment period, which starts October 15 and ends December 7 each year. If you decide to enroll during the annual period instead of the initial enrollment period, a small penalty will likely be incurred.

Medicare Part D Costs

The costs associated with a Medicare Part D plan can vary wildly and depend on several different factors, including

- The types of prescriptions you take and the intervals at which you take them

- Which plan you choose

- If the prescription drugs are on your plan’s formulary

- Whether you receive additional assistance in paying for these costs

- If you travel to a pharmacy within your plan’s network

Along with these general costs, you’ll need to consider your plan’s premium, deductible, and copayment. The monthly premium varies from plan to plan and is the set amount you pay each month for the insurance plan as a whole. Your plan could include an annual deductible, which is a set amount that you must pay for prescriptions until they are covered by the plan. In some cases, you might find a plan with a $0 deductible. As for the copayment, this is the amount you must pay each time you receive a prescription medication, which is typically anywhere from $10-20.

It’s also important that you’re aware of what is known as the “Donut Hole”. Most Part D plans come with a limit to how much can be covered in a single year. Once this limit has been met, you’ll reach a gap between the limit and what is known as catastrophic coverage. Once you reach catastrophic coverage, nearly all of your prescription drug costs will be covered. However, in the gap between the initial limit and the catastrophic coverage, you’ll be required to pay most of the costs yourself. Thankfully, this limit is usually set very high.

Now that you’re aware of what Medicare Part D is and how you can enroll, you can start searching for the plan that’s right for you.