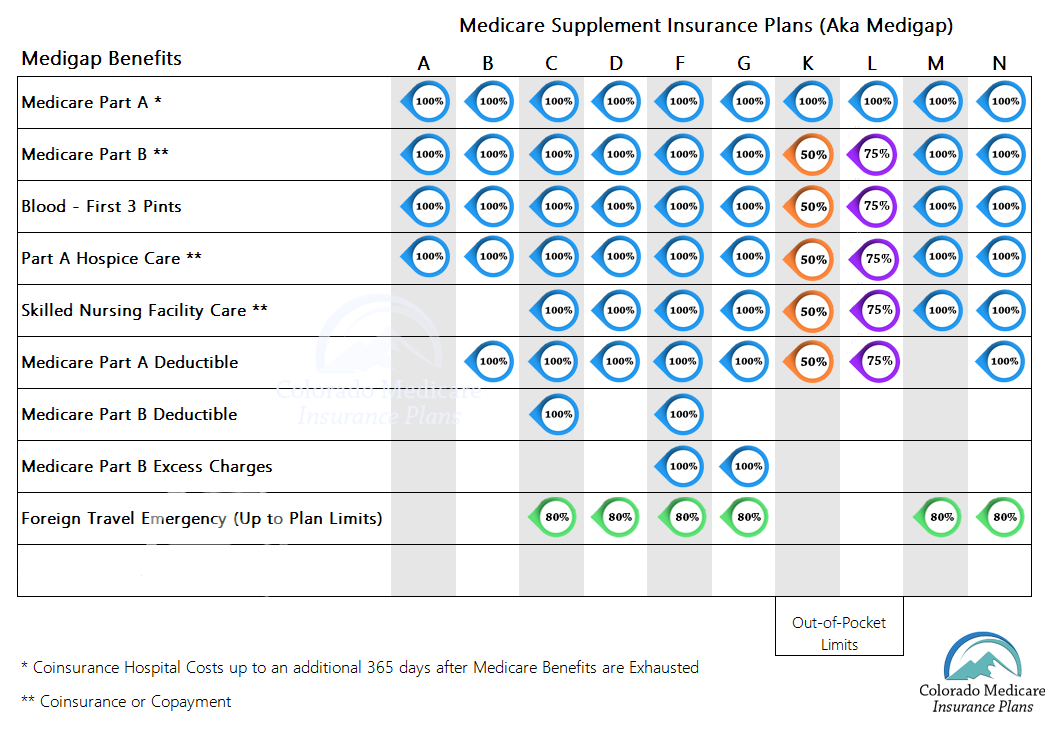

Medicare Supplement Plan D is an often affordable Medicare Supplement option in certain markets. Plan D is designed to cover a number of high risk gaps not covered by original Medicare. You may be attracted to a Plan D option as premiums are often more affordable than other more comprehensive Supplement Plans including  Supplement Plan F.

Supplement Plan F.

Note that Supplement Plan D in Colorado does not include coverage for Medicare Part B deductible or any excess costs for Medicare Part B costs which means if enrolled in the plan you would assume the costs for bills above those approved by Medicare.

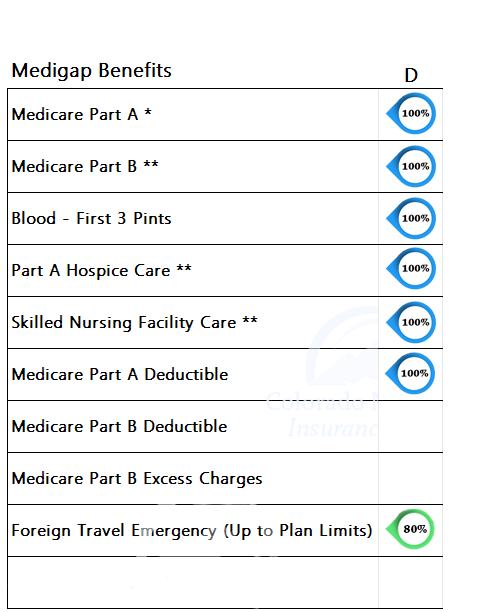

Medicare Supplement Plan D includes the following benefits:

- Medicare Part A coinsurance for hospitalization in addition to coverage for one additional year after Medicare benefits end

- Medicare Part B coinsurance for medical expenses — usually 20% of Medicare-approved expenses — or co-payments for outpatient services

- The first three pints of blood you receive as a hospital inpatient or outpatient (whereas original Medicare typically covers any pints of blood you receive after the first three)

Medigap Plans...

Do You Need a Licensed Health Agent?

- Medicare Part A coinsurance for hospice care

- Medicare Part B preventive care coinsurance

- Medicare Part A deductible

- Skilled nursing facility care coinsurance

- Foreign travel emergency coverage

Medicare Supplement Plan D does not cover:

- Medicare Part B deductible

- Medicare Part B excess charges